BY:

SHARE:

CDS has Arrived.... Next September the HMRC CHIEF import service will be switched off and the only means of declaring goods to Customs in the United Kingdom will be via the new Customs Declaration Service. The CHIEF export service will be switched off six months later at the end of March 2023.

CDS is a replacement for the legacy CHIEF system that has been running in the UK since 1992. CHIEF currently processes around three hundred million customs entries per year.

As with any new system, especially a sophisticated IT system, the delivery will be challenging. And we should know – both Bernard O'Connor and Sarah Adams-Greener were part of the HMRC team that delivered the National Export System back in 2003, and that certainly was a challenging time for HMRC.

CDS is Live

CDS is live in Northern Ireland and has been for imports since 1 January 2021. Here in Great Britain there is already small number of importers completing import customs entries.

CDS Test Service is also Live

In addition to the live service, CDS has a test service which is available to traders who want to train on CDS in advance of live date. This Trader Dress Rehearsal service or TDR can only be accessed through CDS compliant software, so you may wish to speak to your software developer.

CDS is live for S&H

At Strong & Herd we have been completing CDS export and import declarations on the TDR service for some time now and we are starting to get used to the new way of making customs entries. Oh, and yes, we have found it challenging! But we have also found it to be a straightforward and user-friendly system, at least through the software that we are using.

CDS Registration

To access CDS, whether you want to complete Customs declarations, or you just want to download reports from the CDS Portal, you will need a Government Gateway account.

Most VAT registered traders already have a Government Gateway account to file their VAT returns, so adding CDS shouldn't be too difficult. But just make sure you still have those credentials, and of course don’t forget that mobile phone number you used for the 2-stage identification process. Speak to whoever holds the account in your organisation and leave plenty of time to register. Just in case.

Details of the CDS registration process can be found

here.

CDS for the Exporter

As an exporter, you will want to know what declarations have been made on your behalf. Currently you can do this by purchasing the monthly CHIEF MSS Reports which provide full details of what has been declared on your behalf using your EORI, CDS doesn’t work in this way and if you wish to obtain this information from CDS, you will need to register on the CDS portal.

CDS For the Importer

As well as obtaining your declaration information, importers will need access to download monthly Deferment Account statements and PVA statements. So again, you will need to register on the CDS portal.

CDS for the Customs Broker

The freight forwarding community will really feel the changes. They are the ones that complete the customs declarations. Although to be fair, those exporters and importers who complete their own declarations will be affected in the same way.

As a CDS declarant (or representative to use the official language), as well as CDS credentials and a Government Gateway account, you will also need CDS compliant software. If you already use a software developer, check that they are ready for CDS.

A list of software developers can be found on the Association of Freight Software Suppliers (AFSS) website at

The Association of Freight Software Suppliers - AFSS.

These are the current members. Go to the website and click on one of the links to connect with the AFSS member.

HMRC has also published a list of software supplier that can be accessed here:

Software developers providing customs declaration software - GOV.UK (www.gov.uk)

CDS Declarations

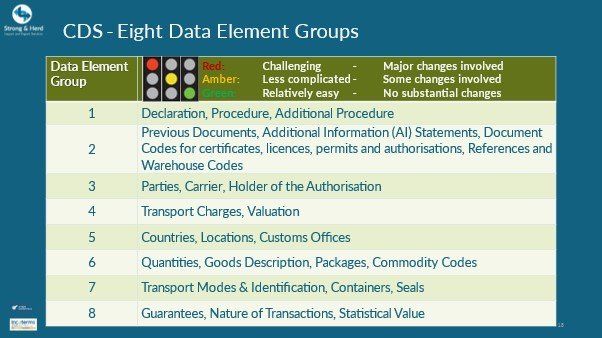

CDS is based around eight groups of Data Elements. There are no "SAD Boxes" and each Data Element Group covers a particular aspect of the customs declaration.

In our CDS export and import training courses we use a traffic light system to indicate the level of complexity of a particular data element. This allows us to spend more time on the RED and

AMBER data elements and less time on the

GREEN ones. Here are the data element groups:

Don't be too disheartened by the considerable number of data elements. Many of them only apply to certain scenarios. In any event, we can guide you through this myriad of data fields on a CDS declaration and make life a lot easier for you.

CDS and CHIEF

There is no easy correlation between CHIEF SAD Boxes and CDS Data Elements so we aren't going to attempt to make any comparison. At S&H we are treating CDS as a completely new system and we are approaching it from that perspective. We have studiously avoided any comparisons to CHIEF in our training as we believe that it is both unhelpful and distracting to the learner.

CDS Paper Entries

CDS is electronic and it was never intended to produce paper documents. However, following consultation between the software developers and HMRC an entry format was agreed and, whichever software developer you use, the paper declaration should look the same. However, it is important to understand that these documents have no legal status and have been produced to assist the trade.

What to watch out for in CDS

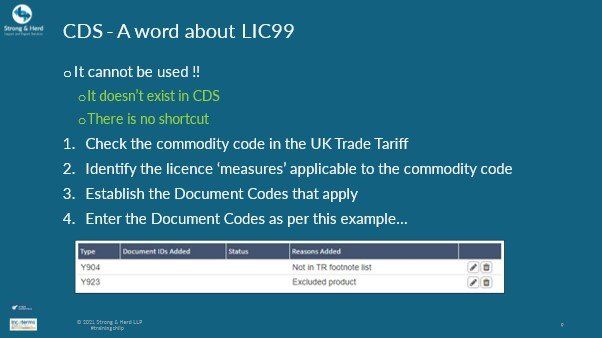

Unlike the old CHIEF system, the new Customs Declaration Service is (our choice of words) "data-hungry". It requires a lot more thought on the part of the declarant and nothing can be assumed with CDS. Here's an example we use in our training that covers licence measures.

You cannot use LIC99 to say that your goods do not require a licence. You must check and understand the licence measure attached to your commodity code in the UK Trade Tariff and then take steps to either declare the licence (if you need one) or explain the reason why a licence isn’t required. Here's a clip from CDS software.

New to CDS

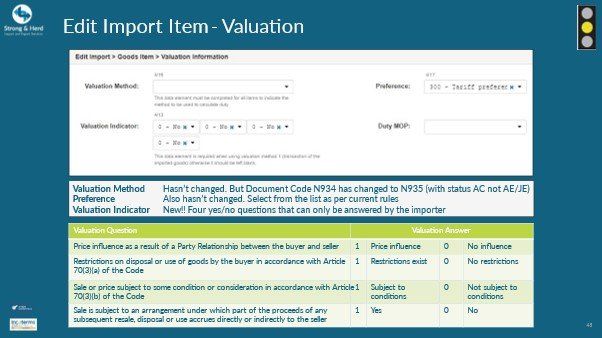

The Customs Declaration Service introduces new data elements that were not previously required on a CHIEF declaration.

Valuation Methods haven't changed but under Valuation Method 1, you must answer four questions about your import and how you arrived at the Customs Value.

These are the questions.

- Is there a price influence as a result of a Party Relationship between the buyer and seller?

- Has the buyer placed any restrictions as to the disposal or use of the goods?

- Is the sale or price subject to some condition or consideration?

- Is the sale subject to an arrangement under which part of the proceeds of any subsequent resale, disposal or use accrues directly or indirectly to the seller?

Here's a slide on the subject from our training course.

Note that the questions cannot be answered by a Customs Broker without first obtaining the information from the importer.

Where do we go from here?

CDS is coming in next year for imports and S&H is preparing the way for existing and new clients.

CDS Training

We are increasing our public training and also our bespoke courses as we head towards the start of CDS next year. November sees the start of our increased support for CDS. Keep an eye on our website for further information.

CDS Helpline

To coincide with November's CDS training activities we are launching a CDS Helpline to run alongside our OneCall subscription service. This is a dedicated priority email service which you can use to send your CDS specific questions. Further information is available on our website.

CDS Clinics

To compliment both our training and our helpline service, we will be holding monthly CDS events where, for 45 minutes, our technical advisors will discuss one or two particular aspects of CDS and then, for a further 45 minutes, attendees will be invited to ask questions about the service and any issues they may have.

The CDS clinics can be booked on-line via our website.

CDS Publicity Material

HMRC has published four factsheets on CDS which you can download from gov.uk. the link is here:

Customs Declaration Service communication pack - GOV.UK (www.gov.uk)

CDS Regulations

Tariff Volume 3 for CDS

UK Trade Tariff: volume 3 for CDS - GOV.UK (www.gov.uk)

Contains the export and import completion rules and the data element codes

CDS Guidance

About The Customs Declaration Service

Customs Declaration Service - GOV.UK (www.gov.uk)

Contains various links to guidance regarding CDS

Register for CDS

Get access to the Customs Declaration Service - GOV.UK (www.gov.uk)

Provides details of to get access to CDS

CDS Service Availability and Issues

Customs Declaration Service: service availability and issues - GOV.UK (www.gov.uk)

We call this the "log-in" page because this is where you can sign in to:

- get access to the Customs Declaration Service

- get your import VAT and duty adjustment statements

- get your postponed import VAT statement

- get copies of your duty deferment statements

- get your import VAT certificates

- manage your email address

Useful links in relation to this months' Spotlight On....

CDS Clinics - Customs Procedure Codes

Join Partner Bernard O'Connor & CDS Specialist Emmanuel Gianquitto they lead our first CDS Clinic, they will be explaining the changes in CPC's with working examples to help you prepare for the changes ahead.

CDS Public Training Courses with Strong & Herd

CDS Exports: The Customs Declaration Service - Strong & Herd LLP

Our CDS export courses always take place on Mondays:

Monday 13 December 2021

Monday 17 January 2022

Monday 21 February 2022

CDS Imports: The Customs Declarations Service - Strong & Herd LLP

Our CDS import courses always take place on Fridays:

Friday 10 December 2021

Friday 14 January 2022

Trade Resources

Glossary of Terms

Industry Insights

Cost effective specialist training, Business Support & Hepline

OneCall™ Email assistance as and when required; A one-call solution for all your import, export and customs enquiries. Export help. Import help. Customs help.

Stay informed about customs and international trade matters by subscribing to our OneCall™ service. This comprehensive offering includes a dedicated email helpline for support, timely practical updates direct to your inbox (Did You Know?), monthly UK Customs & Trade Briefings and access to an interactive members' area with an exclusive community for our subscribers.

International Trade Updates & Spotlight Newsletter

Subscribe to our free information emails covering international trade topics...

MORE INDUSTRY INSIGHTS...