BY:

SHARE:

What is Countervailing?

Countervailing duties (CVD) are specific tariffs imposed on imported goods to offset subsidies provided by foreign governments to their domestic producers, ensuring fair competition.

A regulatory authority imposes countervailing duties in a country where injury is considered to have been imposed on domestic businesses or industries in the importing country by goods or services having benefitted from a subsidy afforded by the regulatory authorities in the country of export.

Introduction to subsidy investigations

The UK's Trade Remedies Authority is the regulatory body that investigates such cases. Cases can be raised by a UK industry or business which must present evidence that goods for import in the UK have been subject to local subsidy before export to the UK.

Evidence submitted is then subjected to a thorough TRA investigation process that will include domestic and foreign party input to ensure robust proof of compliance with the countervailing legislation. The domestic and international legislation stems from the World Trade Organisation's countervailing provisions.

Other measures that could apply are anti-dumping, or safeguarding measures (. However, countervailing is a particular measure where proven evidence determines that goods for import to the UK have been subjected to supportive measures with a positive financial impact within their country of export.

Applying for a trade remedies investigation guidance.

The subsidy investigation:

The Trade Remedy Authority investigation must evidence a robust process. The following is included in the investigation;

- establishing whether a subsidy exists for the goods and whether the subsidy is countervailable

- calculating the amount of subsidy to be attributed to the subsidised imports

- calculating the countervailing duties

- determining whether the subsidised imports have caused injury

- considering whether measures are in the economic interests of the UK

The TRA investigation process guidance can be found at the link below:

TRA’s investigation process guidance.

A subsidy is considered to have been applied if there is either a financial contribution by a foreign authority which confers a benefit on the recipient (usually the recipient is an industry or business manufacturing goods) or a form of income or price support received from a foreign authority which confers a benefit on the receiving party.

Evidencing a subsidy to goods from an exporting country is not easy; hence, the TRA processes must be slick. Subsidies are not always a direct subsidy afforded to a business or industry. They can take the form of provision of goods or services, or uncollected revenue from a company or industry. Collating evidence is a complex process.

Legislative information: General Agreement on Tariffs and Trade 1994 at Article XVI, part of Annex 1A to the WTO Agreement, link below:

WTO | legal texts - The General Agreement on Tariffs and Trade (GATT 1947 )

Not all subsidies are countervailable or justifiable for offset through a trade remedy.

The TRA must establish that a subsidy is countervailable by determining whether a subsidy is specific to a geographical area, an industry, or a particular company, rather than generally to goods for export, and whether a subsidy has been granted either directly or indirectly for the manufacturer, production, export, or transport of goods.

The investigation must provide evidence that the provision of local subsidies before exporting to the UK could harm the UK industry.

Legislation

Primary legislation in the Taxation (Cross-border Trade) Act 2018 (the Taxation Act)

Subsidies are addressed in the Taxation (Cross-border Trade) Act of 2018. A link to the primary legislation is below:

Schedule 4 to the Taxation Act (Dumping of goods or foreign subsidies causing injury)

Secondary legislation in the Trade Remedies (Dumping and Subsidisation) (EU Exit) Regulations 2019 (the D&S Regs)

Regulations 19 to 26 in Part 3 in the D&S Regs set out further provisions dealing with subsidies, including determining whether there is a countervailable subsidy and calculating the amount that can be attributed to subsidised imports.

World Trade Organisation – relevant provisions

Article XVI of the General Agreement on Tariffs and Trade (GATT) and the Agreement on Subsidies and Countervailing Measures (ASCM) sets out the requirements which must be met for WTO members to be able to impose countervailing measures.

What does Countervailing Investigation aim to do?

A countervailing investigation aims to establish whether a foreign authority has made a financial contribution to exports to the UK.

Taxation (Cross-border Trade) Act 2018

The definition of a foreign authority can be found in the Taxation (Cross-border Trade) Act 2018 at Schedule 4:

(3) “A relevant foreign government” means the government of a foreign country or territory—

(a) which granted one or more of the countervailable subsidies in question or

(b) within whose territory it is located, a foreign authority granted one or more of those subsidies.

Determining whether any subsidy has originated from a foreign authority requires thorough investigation, and investigation results are recorded as evidence should any countervailing measure be applied later.

Foreign subsidies can vary substantially in how they are applied. The TRA must ensure within bounds of reasonable doubt that a subsidy has been applied before a countervailing measure can be implemented on import to the UK

How is it implemented?

Once a subsidy has been determined and confirmed, a countervailing measure will be applied to the Tariff in the form of additional duties on imports of the products:

Before a measure is due to expire, the measure will be considered under a Transitional Review, to determine whether the measure is still required and if it should remain in place to protect UK industries from unfair trading practices.

Implementing a Transitional Review: Case Study: Imports of pedal assistance cycles with auxiliary electric motors from China.

Background:

A countervailing duty was placed on electric bicycles from China by the EU on behalf of the UK and the other member states, detail initially published in a Taxation Notice 2020/25 dated 31st December 2020 following a Call for Evidence implemented by the Department of International Trade, now the Department of Business and Trade.

The Secretary of State for Business and Trade transitioned the countervailing duty to continue to apply in the UK after the EU-Exit transition period.

The measure was published as subject to a Transitional Review before the 19th of January 2024.

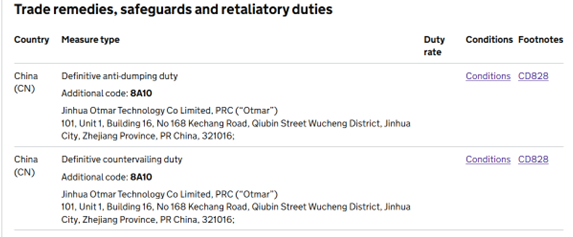

The measure appears on the UK Global Tariff in the example below:

Commodity 8711609010:

How the transition review is initiated

The first stage of the review is to inform the Secretary of State that a Transition Review is being initiated for the product subject to the measure.

The TRA is then obliged to take reasonable steps to ensure that interested parties are duly informed of the review being implemented. Interested parties will include UK businesses affected initially by the subsidised imports. Parties benefitting from the subsidies in their country of export will also be invited to submit evidence. Representation from the authorities in the exporting country will also be invited to participate in review consultations.

A Notice of Initiation is published on the Trade Remedies Service website setting out the scope of the review, and data is collected in the form of questionnaires and data submissions from parties that have registered an interest, then collated for assessment, and calculations, if applicable.

TRA’s investigation process guidance

The case is given a reference and a TRA case email address from where all data is collated and published against that case reference. In this case, the reference afforded is TS0038.

All pertinent data is published in a Public File on the Trade Remedies Service website at GOV.UK with commercially sensitive data being redacted before publication.

A Statement of Essential Facts is also published, which sets out the basis on which the final recommendation will be made to the Secretary of State.

Case details for Electric Bicycles originating in China:

Electric bicycles originating in China - Trade Remedies Service - GOV.UK

Transition Review Initiation for imports of Chinese bikes

Commodities under review TS10038 are as follows:

- 8711 60 10 00

- 8711

- 60 90 10

A link to the Notice of Initiation is below, with a Case Timeline published to confirm timescales.

TS0038 - Notice of Initiation - Electric Bikes from China_20230522083847.pdf

Publishing time scales are essential as parties registering an interest must ensure that case submissions are made in good time. There are measures in place should there be a valid request for an extension to the time period of data submission.

Informal Drop-In sessions are then scheduled to enable Q&A with the case team. These sessions are informal, and no specific information regarding the case will be disclosed or discussed. The Q&A from the Drop-In sessions are then published on the case record as evidence of open discussions.

TS0038 - Note to the file - Q&A from drop-in sessions_20230606081431.pdf

All questionnaires and data submissions are collated and filed in the public file to prove transparency.

Examples of data recorded on the Public File:

Anhui Youken Trade Co. Ltd

Anhui Youken is a Chinese manufacturer of electric bicycles that had previously exported indirectly to the UK through other exporting companies in China. They state their intention to export directly to the UK and are looking for a low tax rate (low duty, without a countervailing measure being applied) or possibly a no-harm ruling. A ‘no-harm’ ruling would mean that imports from this company would not affect the UK industry.

Other foreign businesses stated that the continuation of the measure would harm their businesses in the UK

The TRA must consider an overseas exporter’s request for an individual countervailing amount and calculate an individual amount, providing that:

- the information required is complete and submitted on time as per the published timeline and

- the number of requests for individual calculations does not unduly burden the review and risk delaying its conclusion.

Giant Electric Vehicle (Kunshan) Co Ltd.

The TRA must ensure that those businesses submitting data have a fair hearing. Giant Electric Vehicle (Kunshan) Co Ltd submitted a document making a case for an extension of the timeline to allow for effective collation and submission of data. The TRA judgement and response is then published as a file note for the public documents.

Having considered their application, the TRA determines that granting an extension to the time limit for data submission would not significantly impede the progress of the investigation and has therefore decided to grant an extension to that party.

Countervailing Transitional Review Findings and Final Recommendation

The TRA Transitional Review investigation determined that the importation of the subsidised goods would recur if the countervailing measure were removed, resulting in injury to the UK industry. However, they also found that continuing the measure would not be in the UK's economic interest. Therefore, The TRA submitted recommendations to the Secretary of State recommending the following options...

Item 369 in the Findings and Final Recommendations reads as follows:

Under regulation 100(1B) (a) of the Regulations, where the EIT [Economic Interest Test] is not met, we must consider providing at least one alternative option. We have found a likelihood of both subsidised imports and injury recurring. The alternative options

Included in this recommendation are:

- Option 1: Extending the existing duties - The current countervailing could be extended for five years ad valorem.

- Option 2: Extending the existing duties on folding e-bikes only – A change of coverage could be made to the existing measure, to be extended for five years ad valorem.

The conditions that subsidised imports and injury would continue or recur have been met for both options, but neither option meets the EIT.

370. We confirm that the EIT has not been met for any of the alternative options, so our option within our recommendation is to revoke the measure

The recommendations with options were made to the Secretary of State on 6th February 2025. Option 2 of the recommendation was implemented on 7th February 2025 with a Notice from the Secretary of State dated 6th February confirming the revocation of duties on non-folding e-bikes from China

Detail was also published of the continuation of duties on folding e-bikes to protect British producers operating in this niche market

A link to the publication is below:

Tariffs on non-folding e-bikes from China revoked - GOV.UK

As of February 2025, the UK’s active Countervailing duty measures include:

- Folding E-Bikes from China: Duties extended until January 18th 2029

- Biodiesel from Indonesia: Duties were imposed to counteract subsidies affecting the UK biodiesel industry

- Ironing Boards from Turkey: Duties were applied to address unfair Turkish subsidies impacting directly on UK manufactures

- Continuous filament Glass Fibre Products from Egypt: Duties were established to protect the UK glass industry from Egyptian subsidised product imports

OneCall™ Email assistance as and when required; A one-call solution for all your import, export and customs enquiries. Export help. Import help. Customs help.

Stay informed about customs and international trade matters by subscribing to our OneCall™ service. This comprehensive offering includes a dedicated email helpline for support, timely practical updates direct to your inbox (Did You Know?), monthly UK Customs & Trade Briefings and access to an interactive members' area with an exclusive community for our subscribers.

International Trade Updates & Spotlight Newsletter

Subscribe to our free information emails covering international trade topics...

MORE INDUSTRY INSIGHTS...