BY:

SHARE:

Classifying goods under the customs tariff is an essential activity, and many companies either aren’t aware of the importance or think it’s a non-essential random selection exercise.

In this article, we look at a piece of essential information required for all international movements: the commodity code. Here we will summarise the key steps to identify the correct commodity code.

In 1988, the World Customs Organisation (WCO) developed the Harmonised Coding System (HS) as a universal language to identify goods for customs control and revenue purposes. A key aim of the HS is the promotion of objective, predictable and transparent classification practices. International tariffs are used:

- For the calculation of customs duties and taxes

- To collect international trade statistics

- As a guide when assessing rules of origin

- As a mechanism for protecting the domestic markets and identifying protectionist measures

But what is it?

The Commodity Code is the common name for the entire sequence of numbers used to identify goods within the tariff. Sometimes it’s called the Tariff Number.

The Tariff is the rule book listing all controls and taxes levied against types of products within each Chapter of the HS – the start of the number is generally known as the Tariff Heading (TH). The HS Code is only the first six digits.

Individual countries or territories may want to identify goods in more detail than the HS code. Hence, national tariffs add extra numbers to their tariff codes – often making it an eight or ten-digit number.

Unfortunately, it isn’t always easy to link the description in the tariff to the product we want to classify, for example:

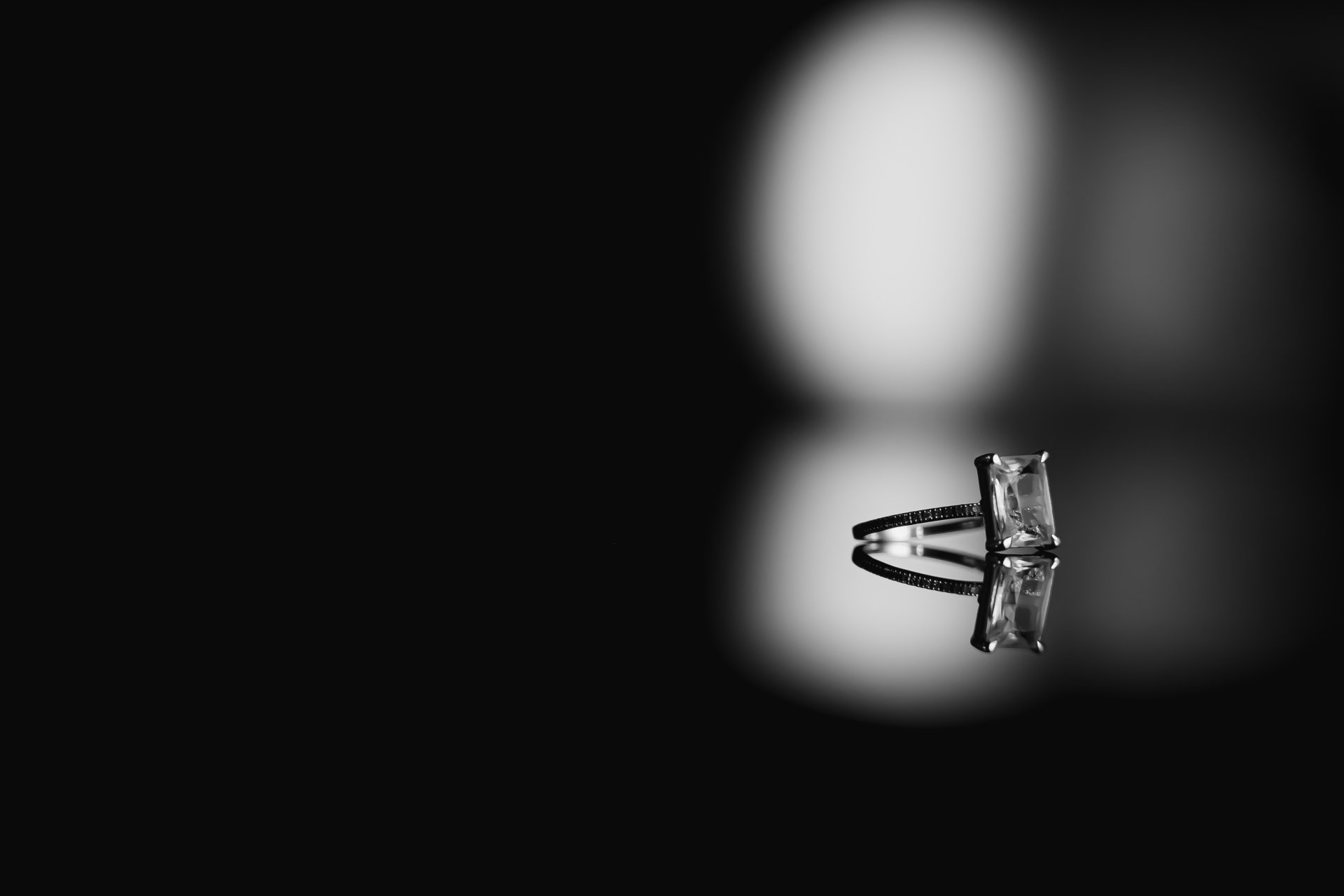

A “Diamond Ring” is called an “Article of jewellery, of precious metal or of metal clad with precious metal” and, in the UK/EU, has a complete commodity code of 71-13-11-0000 if of silver and 71-13-19-0000 if of other precious metal.

This is where our Tariff Classification Explained training is invaluable. Whether you are a Customs Broker wanting to sharpen your skills, or an importer or exporter wishing to further understand the tariff classification process, this course is a must.

How to …

Step 1

What are we classifying? We mustn’t get confused with what we call it, or what it will be sold as, or even what it will be part of, but clearly know what we are looking for. Think of the material it’s made of, its function, and whether it is a single item or, like our ring above, a composite product.

When the HS was designed, the most natural and fundamental products were put first in the sequence, so if you look at the tariff, for example, on the UK HMRC Trade Tariff website https://www.trade-tariff.service.gov.uk, you will see that live animals and plants comes first and the more complicated items like cars, cameras and furniture are at the end of the schedule.

Step 2

Understand what is in the tariff. This brings in the General Interpretative Rules (GIRS), six rules that are part of the Harmonised System’s legal structure. Their use is mandatory when deciding on the correct commodity code.

Rule 1 says to read the Section and Chapter Legal Notes; don’t just look for the nearest description of your goods. The Legal Notes tell you what is covered within each area and, more importantly, what isn’t covered by that Section and then point you in the right direction. It is said that about 90% of all goods can be classified by reading these notes.

Step 3

What to do if you still can’t find it; move on to the other GIRs. Rule 2 explains how to classify unfinished and disassembled goods. Rule 3 covers a mixture of goods/materials by focusing on a) specific description, b) essential character or c) last in numerical order. Rule 4 is rarely needed, and you will need a customs ruling to justify using this rule, whereby you classify your goods against a number related to a similar item. Rule 5 helps us decide if we must find a commodity code for the external packaging. We should now have the Tariff Heading (the first four digits). Rule 6 will help us complete the HS code. But if you still can’t find it, move on to the other GIRs.

Step 4

Still struggling? We probably need external assistance reviewing any classification guides available; UK HM Revenue & Customs publish lots of helpful product classification guides. Contact customs for assistance (in the UK email: classification.enquiries@hmrc.gsi.gov.uk ,or consider applying to customs for an Advanced Tariff Ruling (ATaR) in GB, or a Binding Tariff Information (BTI) ruling in Northern Ireland or the EU.

Understand what is in the tariff

It isn’t easy to classify, and there are examples of complex classification cases that even have customs officials disagreeing, but for most of us, the code can be found if we follow the steps. This includes the General Interpretative Rules (GIRS), six rules part of HS’s legal structure. Their use is mandatory when deciding on the correct commodity code, and Rule 1 says to read the Section and Chapter Legal Notes; don’t just look for the nearest description to your goods.

Or we could take a shortcut. If you use the UK Trade Tariff, look at the top of the page on the black header and you’ll see “A-Z” Click on this and select the letter relating to your goods, and there you’ll find a plain language description where under “D” we find our “Diamond Ring”.

While you are here, you may be interested in some Strong & Herd LLP training courses related to this topic:

Tariff Classification Explained - Technical Workshop

International Trade Compliance Manager Two Day Workshop

OneCall™ Email assistance as and when required; A one-call solution for all your import, export and customs enquiries. Export help. Import help. Customs help.

Stay informed about customs and international trade matters by subscribing to our OneCall™ service. This comprehensive offering includes a dedicated email helpline for support, timely practical updates direct to your inbox (Did You Know?), monthly UK Customs & Trade Briefings and access to an interactive members' area with an exclusive community for our subscribers.

International Trade Updates & Spotlight Newsletter

Subscribe to our free information emails covering international trade topics...

MORE INDUSTRY INSIGHTS...