BY:

SHARE:

On the 30th of September 2023, the UK and EU implemented additional import controls on iron and steel products under the Russian Sanctions legislation. The regulations apply to all imports, though the focus is on establishing if the iron/steel used in manufacturing products within Chapters 72 and 73 of the tariff originated or was processed in Russia. This means UK and EU importers will need to hold evidence from their overseas suppliers on production information of items such as steel screws.

This is the first phase covering iron and steel products as listed in Annex XVII of the EU Regulations, as adopted in the UK, imported, or purchased directly or indirectly in a third country incorporating iron and steel products originating in Russia. Phase 2 will apply from April 1st, 2024, on products listed in Annex XVII - goods under codes 7207 11, 7207 12 10 or 7224 90 processed in a third country incorporating steel products originating in Russia of CN code 7207 11. Phase 3 will apply from 1st October 2024, for CN codes 7207 12 10 and 7224 90.

Here are the UK Regs: https://www.gov.uk/government/publications/notice-to-importers-2953-russia-import-sanctions/guidance-on-third-country-processed-iron-and-steel-measures

Here are the EU Regs: https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=CELEX:02014R0833-20231001

On the 2nd of October 2023, the EU issued a fact sheet; from page 9 onwards, it provides clear guidance for EU Importers: https://finance.ec.europa.eu/system/files/2023-10/faqs-sanctions-russia-listed-goods_en.pdf

UK Guidance provides four scenarios, 2 of which confirm imports that are outside the controls – we recommend you review the UK guidance, but for quick reference, here is one of the scenarios outside the current change in the regulations:

Scenario 4

A product of Russian origin that is a good listed in Schedule 3B when it leaves Russia is then processed in a third country into an entirely different product (a good not listed in Schedule 3B). Importing this into the UK is not prohibited under the Russia Regulations.

For example, coils of stainless steel (HS 7219 – 7220) of Russian origin are exported from Russia and enter country X. Here, they are used to manufacture a car (HS 8703), which is now considered to be of country X origin and is imported into the UK.”

For goods going into the EU, each member state appears to have its own version of the evidence required to establish the origin of the material used, but it is based on an EC Europa Document. Many EU member states say they will accept a supplier declaration, though ideally there should be a Mill Test Certificate (MTS). The UK authorities have not confirmed the use of a supplier declaration, or provided a detailed guide on what a UK importer will be required to hold as evidence but summarise in their guidance the following:

Demonstrating supply chain history

Traders should be prepared to have documentation available to demonstrate evidence of a goods’ supply chain, which must be consistent with the prohibitions under the regulations.

Evidence requested to be provided through documentation could include:

- the country of origin of the iron and steel products processed in the third country (or third countries) after the fact

- the date that the iron and steel product left its country of origin

- the country(ies) and facility(ies) where processing has taken place

- An example of evidence may include, but is not limited to, a Mill Test Certificate (MTC) or Mill Test Certificates (MTCs), where the relevant information cannot be summarised in a single document.

The importer is responsible for holding this evidence before importing goods covered by these controls, i.e., goods within Chapters 72 and 73 of the tariff. Goods may be detained by customs at import to check if the importer has obtained sufficient information. However, this is unlikely to apply to all imports, as post-clearance checks seem to be the primary way customs authorities will monitor this sanction.

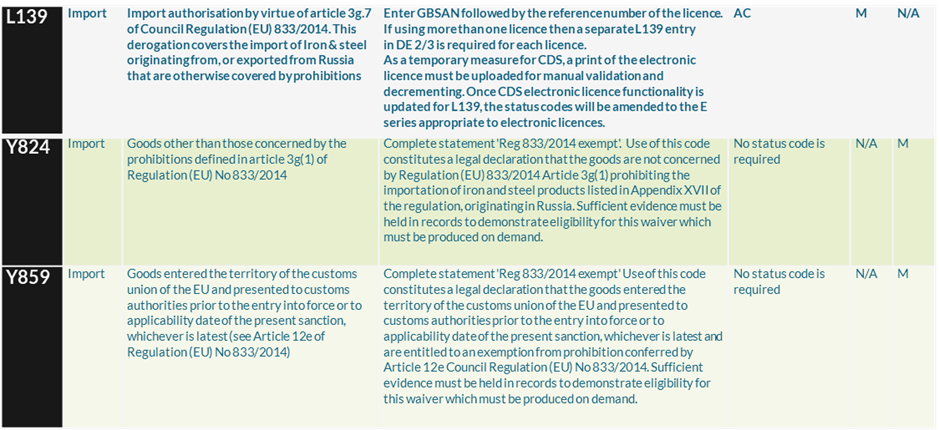

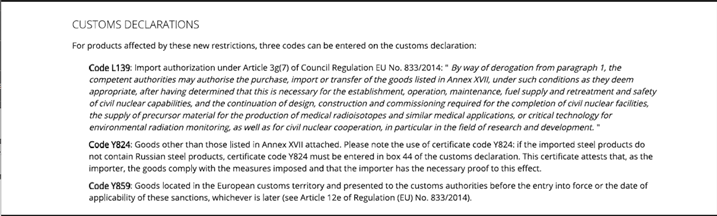

Documents codes that are linked to sanctions on Russia are shown below. Though it has currently been confirmed by the UK Import Controls body that there are no requirements to enter these codes on a customs declaration covering the import of Chapter 72 and 73 - goods in the European Commission's recent FAQs (2nd October 2023). They confirm that to indicate the MTC and/or any other document used as evidence, then a document code, such as Y824 must be used on the customs import entry.

EU import codes are slightly different.

Remember, shipments from GB into Northern Ireland will come under EU regulations.

We have asked HMRC, DBT (Department for Business & Trade) import controls, and ILB (Import Licensing Branch), for additional information, as these regulations appear to have no exceptions for reusable packaging, transport containers, low-value shipments, goods shipped temporarily, or hand-carried goods. We will update you as soon as we receive further information from the UK, though the European Commission have covered most of these points in their guidance for EU importers.

OneCall™ Email assistance as and when required; A one-call solution for all your import, export and customs enquiries. Export help. Import help. Customs help.

Stay informed about customs and international trade matters by subscribing to our OneCall™ service. This comprehensive offering includes a dedicated email helpline for support, timely practical updates direct to your inbox (Did You Know?), monthly UK Customs & Trade Briefings and access to an interactive members' area with an exclusive community for our subscribers.

International Trade Updates & Spotlight Newsletter

Subscribe to our free information emails covering international trade topics...