BY:

SHARE:

On the 31st of January 2024, HMRC withdrew the use of waiver code 999L on CDS Imports, permanently removing this option for UK Importers, resulting in confusion among some traders regarding the subsequent actions to be taken.

Traders must utilise the Trade Tariff tool to identify any import measures linked to the goods and refer to the guidance to determine the relevant document code. Successfully sourcing replacement codes for 999L hinges on the capacity to comprehend and navigate the Tariff, discerning the goods and any pertinent legislation governing their import into the UK.

It is important to note that many of these codes were in existence within the Tariff prior to 999L being removed, and traders must adhere to all applicable legislation when importing goods into the United Kingdom. During audits, HMRC may request evidence demonstrating the rationale behind the selection of a specific code concerning import measures.

Below is an example demonstrating how to navigate the Trade Tariff to identify the document codes now required for CDS Imports as a replacement for 999L.

Example

1. Visit https://www.trade-tariff.service.gov.uk/ and input the Commodity code.

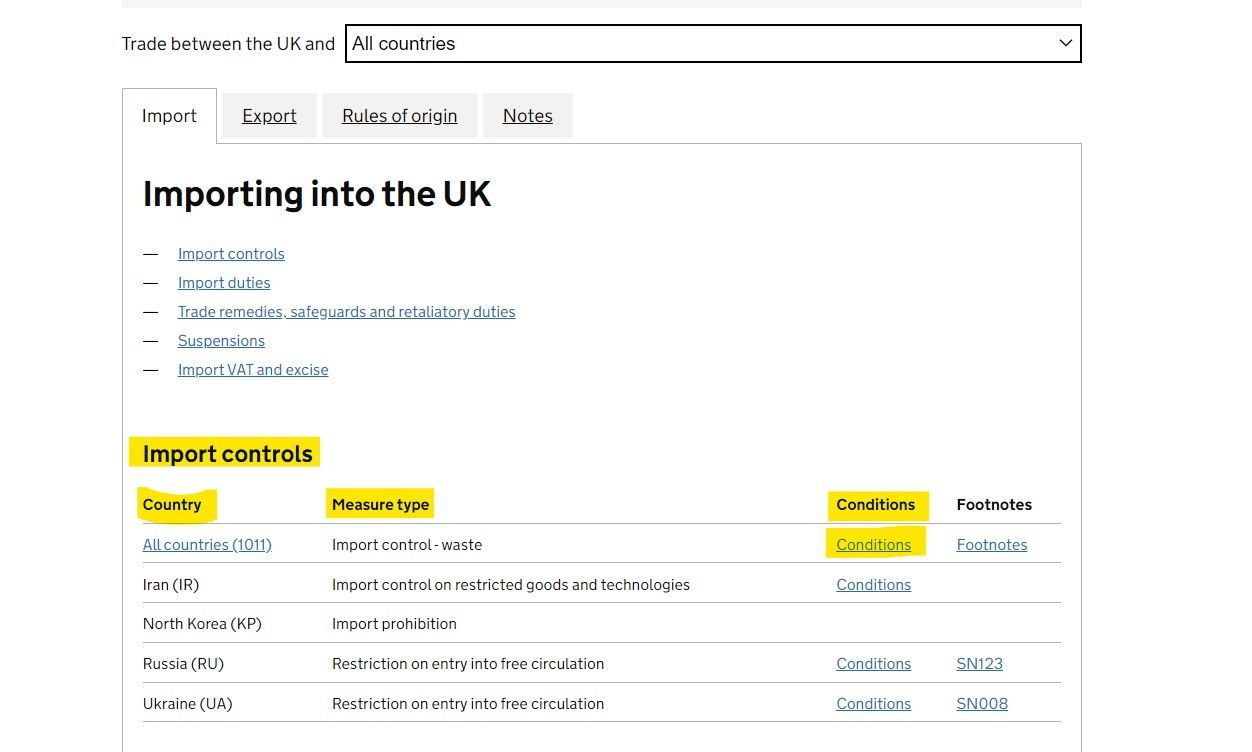

2. Keep the default setting for trade between the UK and All Countries.

3. Navigate to the "Importing into the UK" section and locate the ‘Import Controls’ tab to determine if the measure type is applicable to the goods.

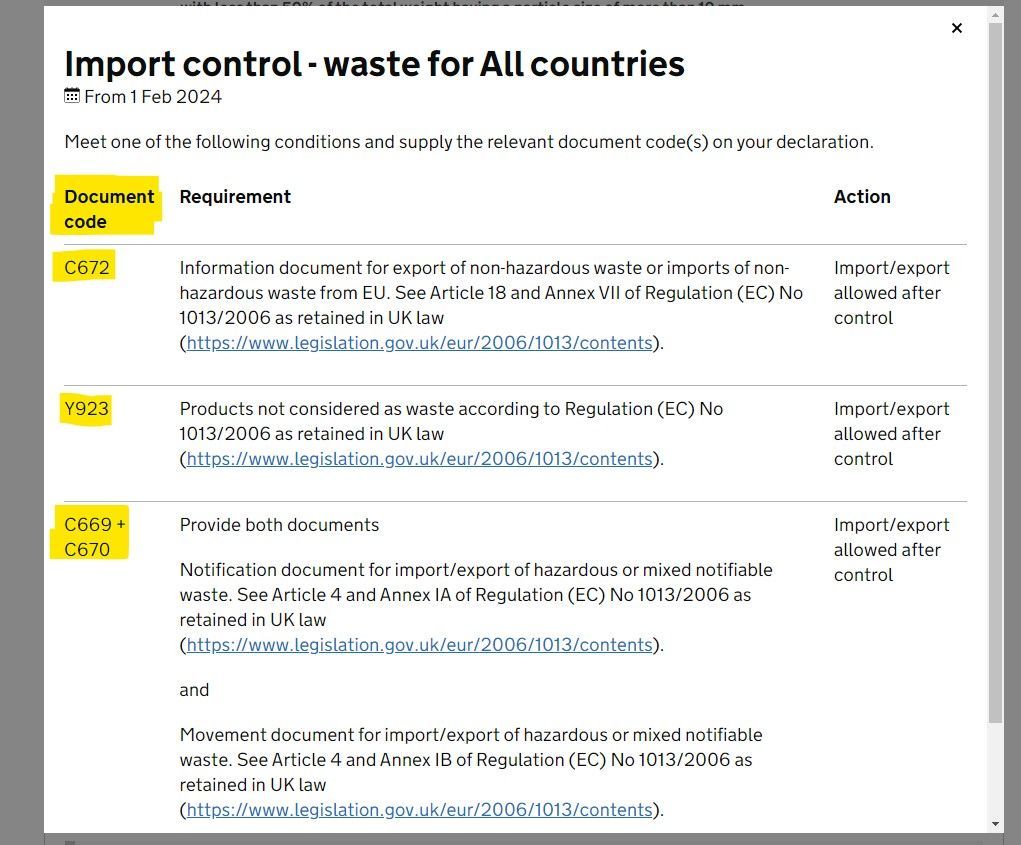

4. Click on "Conditions" to open the relevant window. For this demonstration, the user has selected the conditions for all countries; however, it should be determined if any of the other countries' specific conditions apply to the goods. Within this Commodity code, there are three scenarios to consider for products, each requiring careful review. Ensure to read through each scenario and follow the legislation links, if needed, to determine the applicable code or combination of codes for the goods being imported.

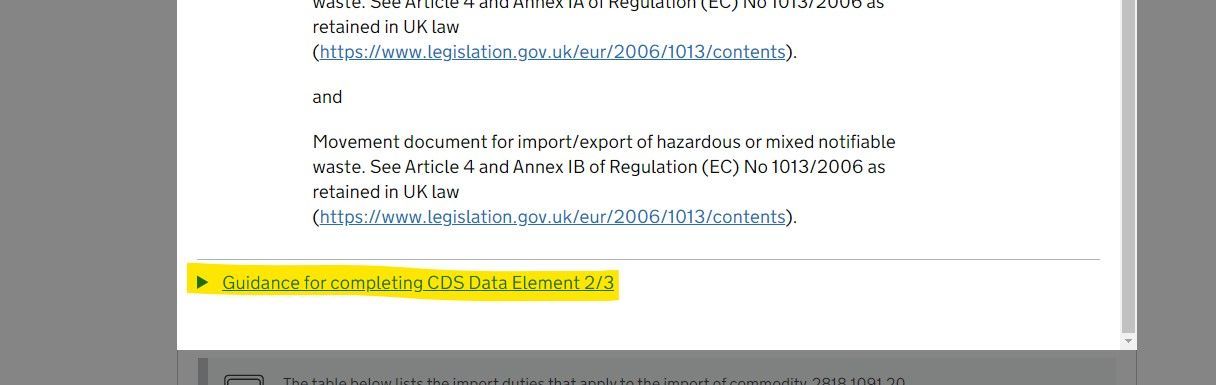

5. Once the user identifies the correct code, they should scroll down in the ‘Condition’ tab. An option to access guidance for completing CDS Data Element 2/3 will be available.

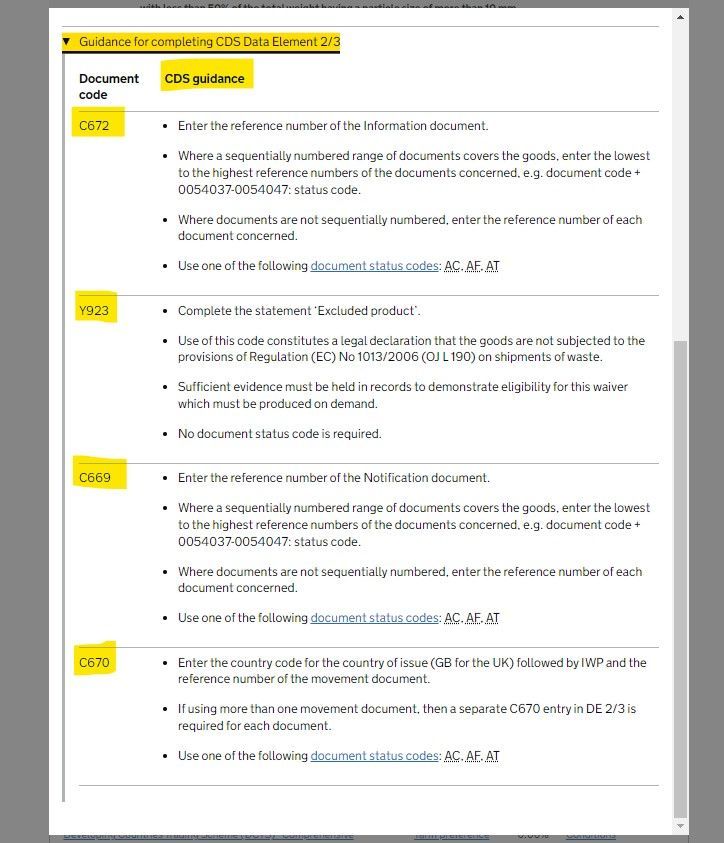

6. Upon opening the provided link, the CDS guidance corresponding to each document code will be displayed

Correctly complete the import declaration using the alternative code to 999L or provide instruction to the agent submitting the import declaration

8. Repeat these steps for each Commodity code where 999L was previously used

OneCall™ Email assistance as and when required; A one-call solution for all your import, export and customs enquiries. Export help. Import help. Customs help.

Stay informed about customs and international trade matters by subscribing to our OneCall™ service. This comprehensive offering includes a dedicated email helpline for support, timely practical updates direct to your inbox (Did You Know?), monthly UK Customs & Trade Briefings and access to an interactive members' area with an exclusive community for our subscribers.

International Trade Updates & Spotlight Newsletter

Subscribe to our free information emails covering international trade topics...