BY:

SHARE:

HMRC recently published guidance on amending and cancelling import customs declarations under CDS.

The HMRC guidance can be accessed here:

Amend or cancel a Customs Declaration Service import declaration - GOV.UK (www.gov.uk)

Here is our take on the guidance....

Amendments

Declarants can use their CDS software to submit amendments to import declarations, but only under certain circumstances.

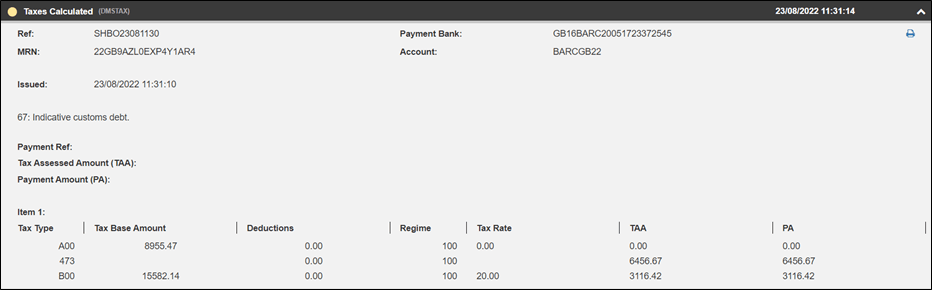

When an import customs declaration is accepted by CDS, and there is revenue due to HM Revenue & Customs, the system generates a tax calculation message (DMSTAX) detailing the “indictive customs debt”.

At this stage, the declaration has been validated and accepted by the system, but it has not yet been cleared.

The term “indicative” means that the tax revenue details could change.

The messages and notifications received after making a successful amendment will depend on the type of declaration being amended.

Indicative Customs Debt

If you have received the indicative tax calculation message but have not yet received the final tax calculation message, then you can amend the customs declaration.

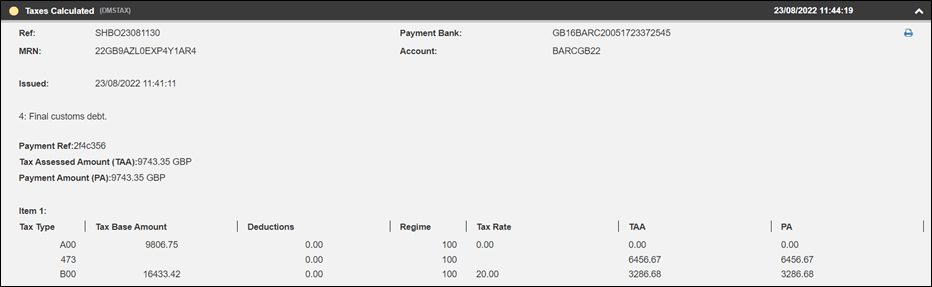

This “indicative customs debt” will eventually change to a “final customs debt” upon customs clearance. When this happens, the system will generate a new tax calculation message (DMSTAX) detailing the “final customs debt”.

Final Customs Debt

Once you have received this final tax calculation message, you cannot amend the customs declaration.

Exceptions

However, there are a couple of circumstances where a tax calculation message showing an “indicative customs” debt cannot be amended:

- A claim to Tariff Quota is being made, meaning the tax calculation at the end of the dwell time is provisional

- Your account does not have enough balance to cover the customs debt (an alert will be issued to resolve this)

After you receive the final tax calculation message or if any of the above scenarios apply, you cannot amend your declaration.

Dwell Time

For “arrived” declarations (IMA), the final tax calculation message (DMSTAX) is usually received ten minutes after the declaration has received an acceptance message (DMSACC). It is usually accompanied by the cleared message (DMSCLE).

For “pre-lodged” declarations (IMD), the final tax calculation message will not be received until the declaration has been “arrived” on CDS and a cleared message (DMSCLE) has been received.

Remember: Once the final tax calculation message has been received, you can no longer amend the import declaration. You will need to apply for a:

- voluntary clearance amendment (underpayment) (C2001)

- repayment of import duty and VAT if you’ve overpaid (C285)

The Customs Declaration Service - Cancelling an Import Declaration

Cancellation in the Customs Declaration Service is referred to as ‘invalidation’.

An invalidation request can be made up until the declaration is cleared.

If the declaration has not yet arrived, the invalidation will be automatically accepted.

If the declaration has arrived and is under control (route 1 and route 2), the Customs authority (HMRC, UK Border Force or Trading Standards) will decide if the invalidation request should be accepted.

If the declaration is subject to a rejected amendment, it cannot be invalidated until the rejection has been resolved.

Once a declaration is cleared, it cannot be cancelled. You will need to apply for either a:

· voluntary clearance amendment (underpayment) (C2001)

· repayment of import duty and VAT if you’ve overpaid (C285)

New Paragraph

OneCall™ Email assistance as and when required; A one-call solution for all your import, export and customs enquiries. Export help. Import help. Customs help.

Stay informed about customs and international trade matters by subscribing to our OneCall™ service. This comprehensive offering includes a dedicated email helpline for support, timely practical updates direct to your inbox (Did You Know?), monthly UK Customs & Trade Briefings and access to an interactive members' area with an exclusive community for our subscribers.

International Trade Updates & Spotlight Newsletter

Subscribe to our free information emails covering international trade topics...

MORE INDUSTRY INSIGHTS...