BY:

SHARE:

What is a Letter of Credit?

A letter of credit (L/C) is a robust means of payment typically used in international trade. It comprises documents sent from a bank or financial institution, providing a solid guarantee that a seller will receive a payment on time and for the full amount.

That sounds ideal. So, it takes all the risk out of getting paid, doesn’t it?

Up to a point.

International trade involves a myriad of risks, both for the buyer and the seller. Using an L/C can alleviate or even avoid some of these risks, but it is crucial to understand that the promise of payment depends on the seller complying with the terms and conditions of the L/C.

So, what are the risks that a letter of credit does not cover?

A seller who receives a letter of credit stands to receive payment from the issuing bank. That means that if the buyer does not pay the bank (for example, the buyer goes out of business), the bank still must pay. So, the letter of credit removes what is called customer risk.

Up to this point, the letter of credit does not help with country risk. If the buyer’s (and therefore the bank’s) country hits problems, they may be unable to pay you.

What sort of problems?

If the country cannot acquire foreign currency on account of its poor financial status, if there is political turmoil, that means the government is not functioning, or if there are serious technical issues, such as the non-functioning of the country’s infrastructure, then the seller might not receive payment.

Is there a way to handle this country's risk?

Yes, there is a way to handle country risk. The seller can request for the letter of credit to be confirmed by a bank in their country. Ideally, it will be a bank nominated by the seller, perhaps the seller's bank. This confirmation provides an additional layer of security, as the confirming bank will then seek payment from the issuing bank, which will receive payment from the buyer.

It sounds too good to be true…

While a letter of credit can offer a level of security in international trade, it is important to consider the potential drawbacks. There are fees associated with the issuing bank, and the seller's access to funds may be restricted due to the L/C. Additionally, if the L/C needs to be amended or re-issued due to changes in the transaction, this could incur additional bank fees.

Another potential problem with L/C’s is that they are inflexible. If the needs of the customer or the seller change (for example a change to the quantities or delivery date), the L/C will need to be amended, or possibly re-issued. Either will involve paying bank fees.

How much are these fees and who pays them?

The fees vary according to the bank, the countries, the perceived level of risk, the value of the transaction and the level of risk that the bank perceives. Before agreeing to an order on an L/C payment, check with the issuing/confirming bank about the charges, and agree with the customer who is going to pay.

Are there any other risks?

Unless the L/C is drawn up in the seller’s currency, then the seller is exposed to currency fluctuation risk. That is, if the currency of the L/C is worth less against the currency in the seller’s country when the payment is made, the seller will receive less than expected. This is a risk that either the buyer or seller face in all international transactions (except where there is a common currency, such as in the Eurozone), and there are ways of managing or avoiding that risk, which we will save for another time.

And, very importantly, banks have strict legal obligations to avoid transactions that may be illegal, such as those involving bribery, fraud or slavery. Even with an L/C, the seller needs to practice due diligence and ensure that the customer and the transaction are both genuine and legal. Failure to do this may result in the bank refusing to pay.

What is meant by Strict Compliance?

Because banks are assessing the delivery on documents alone, they have an obligation to check every detail of each document with great care. What may seem like trivial issues, such as a minor spelling error, omission of a detail, or a small variation in numbers, can oblige a bank to refuse payment. Banks report that around 75% of L/C’s are refused on first presentation. So careful attention to detail is crucial.

When does it make sense to use a Letter of Credit?

From the seller’s point of view, an L/C is typically a beneficial means of payment when the seller perceives there is a significant risk of non-payment. Typically, this will be on larger transactions, usually involving a country where the financial risk is high.

In some circumstances, L/C may be the only means of payment that a buyer can offer. For example, where a country has restrictions on access to foreign currency, or where the contract is a public or semi-public body, and the national government makes an L/C a condition of the business.

In many circumstances, an L/C will be unattractive to the buyer due to the costs involved, and they may even prefer to make part-payment, or even full payment, in advance.

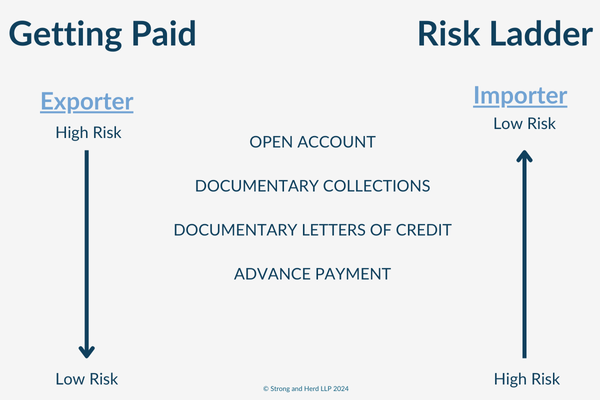

What is the risk ladder?

The risk ladder (see the illustration) is a comparison of common payment methods in international trade and shows how much risk they carry for the buyer and the seller. Payment in advance presents negligible risk to the seller, but an extremely elevated risk to the buyer. Open payment terms, where the buyer pays after shipment, or even after receipt of the goods, is much less risky for the buyer but more so for the seller. An L/C can provide an acceptable level of assurance for both parties, provided the costs and the lack of flexibility are not excessive.

If you are interested in exploring this topic further, you might find it worthwhile to consider the training courses and live clinics offered by Strong & Herd LLP:

With thanks to Tim Hiscock for this month's Spotlight On.

OneCall™ Email assistance as and when required; A one-call solution for all your import, export and customs enquiries. Export help. Import help. Customs help.

Stay informed about customs and international trade matters by subscribing to our OneCall™ service. This comprehensive offering includes a dedicated email helpline for support, timely practical updates direct to your inbox (Did You Know?), monthly UK Customs & Trade Briefings and access to an interactive members' area with an exclusive community for our subscribers.

International Trade Updates & Spotlight Newsletter

Subscribe to our free information emails covering international trade topics...