BY:

SHARE:

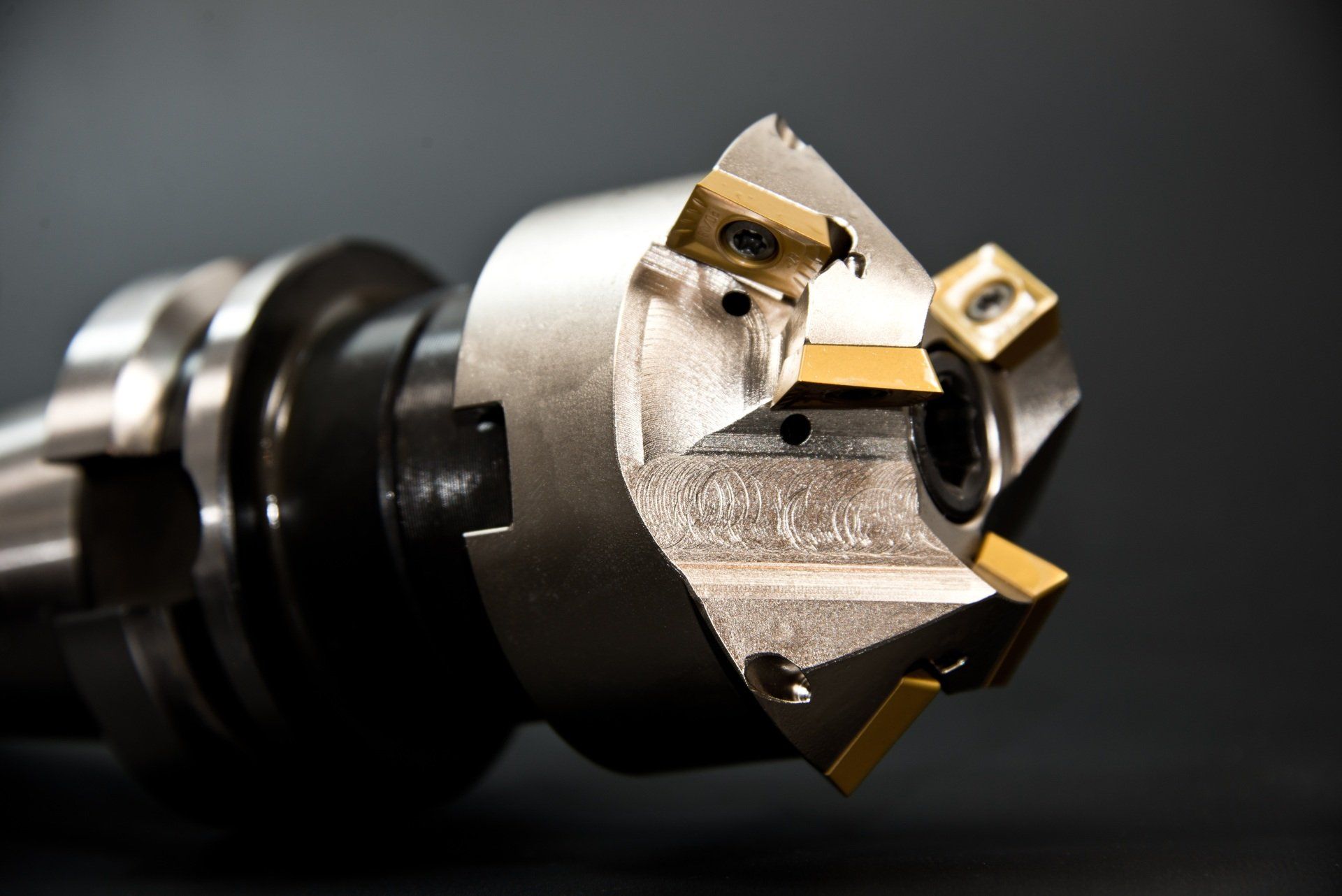

Tools that are duty-free in the UK Trade Tariff leaving the UK to be sharpened in an EU country and re-imported into the UK.

VAT Payable - Non-Warranty Repair

Export through CHIEF

Customs Procedure Code 2200 000 can be used for duty-free goods that are being temporarily exported outside the UK for process, repair, adaptation, reworking or making up. Use of this code constitutes a declaration that the goods are intended for temporary export, for the purpose of processing or treatment outside the UK, and for re-importation after completion of the process.

Export through CDS

Customs Procedure Code 2200 B54 can be used to for duty-free goods that are being temporarily exported outside the UK for process, repair, adaptation, reworking or making up. Use of this Procedure Code constitutes a declaration that the goods are intended for temporary export, for the purpose of processing or treatment outside the UK, and for re-importation after completion of the process.

Note: Procedure 2200 B54 cannot be used if the goods are only duty-free by virtue of a Free Trade Agreement. Procedure 2200 B53 must be used instead.

Note that the procedure can only be used 3 times in any 12-month period.

Scenario

In our scenario, the tools are being temporarily exported outside the UK for a process (sharpening). They will then be re-imported to the UK after completion. The “Process”, sharpening in this case, would be subject to VAT on importation to the UK under the following guidelines.

Re-import through CDS (CHIEF Can no longer be used)

Procedure 6122 B06 should be used to re-import the duty free goods after processing, with VAT chargeable at importation (unless exemption is claimed) on the following value:

- The freight charged for the transport to and from the processor’s premises (but not insurance)

- The price charged for the process, repair or service, including any charge for parts and materials

To declare the amount of VAT payable on an import customs declaration, Tax type code B00 should be used, with the amount of VAT payable or postponed manually calculated.

HMRC advises that the use of Procedure 6122 B06 constitutes a declaration that the goods:

- Were previously exported outside the UK

- Were exported using CPC 22 00 000 in SAD Box 37 under CHIEF, or

- Were exported using Procedure 22 00 B54 in DE 1/10 and 1/11 under CDS

- Were intended at the time of their export to be re-imported after completion of the treatment or process outside the UK

- Have been repaired, processed, adapted, reworked or made up outside the UK

- Ownership was not transferred to any other person at exportation or during the time they were outside the UK

To conclude, the tools which were temporarily exported for a process (sharpening) are subject to VAT at importation on the cost of the process, including parts and materials used in the process.

VAT Exempt - Warranty Repairs

An example of VAT not being payable upon importation would be where the “tool” was under a warranty or was faulty and was being repaired as a part of this cover. VAT exemption would apply and therefore, VAT would not be payable at re-importation.

OneCall™ Email assistance as and when required; A one-call solution for all your import, export and customs enquiries. Export help. Import help. Customs help.

Stay informed about customs and international trade matters by subscribing to our OneCall™ service. This comprehensive offering includes a dedicated email helpline for support, timely practical updates direct to your inbox (Did You Know?), monthly UK Customs & Trade Briefings and access to an interactive members' area with an exclusive community for our subscribers.

International Trade Updates & Spotlight Newsletter

Subscribe to our free information emails covering international trade topics...