BY:

SHARE:

What are Safeguarding Measures?

Trade Remedies or Trade Measures are internationally agreed trade control methods implemented at the country level to balance domestic and international markets, safeguarding the local domestic market.

A safeguard is a temporary restriction that a country may impose on the import of a given product, where imports of that product may substantially increase and threaten to cause serious injury to a domestic industry that produces a similar or directly competitive product.

As this is an agreed international trading measure, the implementation of the measure must be justified with compliance evidence to support its use.

A UK business or industry may register an interest with the Trade Remedies Association, which will follow due process, investigate, and then present a ruling to the Department of Business and Trade (DBT)

Safeguarding restrictions can consist of trade quotas or restrictions on goods' origin. With quota restrictions, the quantity of goods for import is restricted or allowed for import to a specific amount, where a higher tariff will be applied. As an example, the quota for steel is provisioned quarterly, and once that quota is accounted for, any further imports for given tariff codes would be subject to a 25% tariff.

A restriction specific to the origin of goods would relate to a given country.

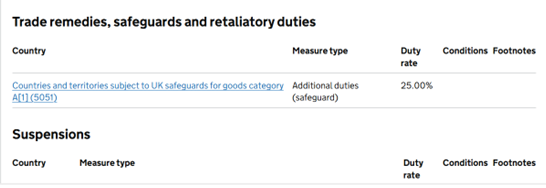

If the TRA ruling is found to be in favour of the business, or industry registering the interest, a measure will be implemented as a working border restriction on the product, usually in the form of a quota. This temporary restriction or trade barrier is a ‘safeguard measure’ and will be visible in the tariff as an additional duty.

A safeguard restriction is intended to allow an economy to recover or to give industry the opportunity to adjust its business processes to increase its ability to compete in its given market within a given timeframe. This timeframe can be adjusted, but such changes are tightly regulated. All Trade Remedies Authority processes are regulated and subject to audit as well as external scrutiny.

How Safeguarding Works

First steps:

A business, organisation or industry completes a TRA questionnaire, which gives the trade issue visibility. The TRA is responsible for providing a public notice detailing the proposed safeguard measure to all interested parties, therefore allowing the industry to comment. Businesses that may be affected by the proposed safeguard action may also be contacted directly.

Safeguarding is very different from other trade measures. Countervailing and Anti-dumping measures are implemented to guard against unfair trading practices. Safeguarding looks to support the local market from being overwhelmed by competition where imports of the same or similar goods are cheaper than those manufactured locally. Therefore, the interested parties would need to raise a case to support the request for implementing a safeguarding measure. The case then follows due process within the Trade Remedies Association and, if successful, is presented to the DBT.

After the measure is applied, the restriction will appear on the UK Global Tariff as a Trade remedy, safeguard and retaliatory duties note

A safeguard as a measure will be implemented for a specified period. After that, the measure will be reviewed and, if necessary, extended for no longer than an agreed time. The salient point is that the affected industry should improve its processes, productivity, or effectiveness to compete fairly with imported goods.

In the same vein as requesting the implementation or extension of a measure, an interested party may request that a measure be suspended. The submission for the suspension request requires the same quality of evidence to prove that the import measure should be suspended or lifted. In the case of Tata Steel, a request was submitted to remove a safeguard measure on Category 1 Steel imports.

Case Study: UK Trade Remedies – Safeguarding Steel

Background

Tata Steel, an India-owned UK steel manufacturer based in Wales, registered an interest in the Trade Remedies Authority Suspension Review of Category 1 steel imports, submitting documents to make a case for suspending an existing steel safeguarding measure.

At this point in time, Tata was starting to move their steel production to greener steel electric arc production methods, which would mean the steelworks would be out of production long enough to impact their ‘downstream’ assets and operations.

In their submission documents, their case identified that the steel domestic market would be adversely affected should the import measure for Category 1 Steel Goods remain in place.

The documents were, therefore, submitted for a TRA Suspension Review. The review is tasked with considering the following:

- Whether the market conditions have changed temporarily;

- Whether serious injury caused to the UK producers is unlikely to recur if the application of the safeguarding remedy were to be suspended;

- Whether the suspension is appropriate; and

- The appropriate length of any suspension.

In this case, the Trade Remedies Review was to consider whether it would be appropriate to suspend the safeguarding remedy on Category 1 steel products:

- Category 1 steel is commonly used as a raw material for other types of steel and makes up almost a third of all steel production globally.

- Downstream processing refers to using an original product, in this case, hot rolled flat steel, to produce commercialised steel products to be sold to the public.

With Tata unable to manufacture sufficient domestic supplies of Category 1 steel, downstream processing in the UK would be adversely affected.

The documentation submitted by Tata to support the suspension of the measure can be found at the link below. Note that part of the submission details that continuation of the safeguarding measure would have a negative effect on Tata’s downstream assets and operations. In this example, the downstream processing issue becomes a pivotal factor in the eventual decision made by the TRA review and the creation of Category 1B steel for import compliance purposes.

Category 1 Suspension Review TSUK Non-Confidential Application_20240209104352.pdf

As part of the review process, other interested parties are encouraged to make submissions as to the possible impact of a safeguarding measure being implemented, suspended, or lifted.

All case documents are submitted and published, and some commercial redacting is allowed before public publication.

A link to this case review and submitted business case documentation can be found here:

Non-alloy and other alloy hot-rolled sheet and strips - Trade Remedies Service - GOV.UK

The case file presents all published affected tariff commodity classifications, and a ‘public file’ tab links all business representations submitted to the TRA.

Below is a link to the business case submitted by Salzgitter Mannesmann UK Ltd and Salzgitter Mannesmann International GmbH. This business submits that its own downstream customers would be adversely affected if the safeguarding measure were to be lifted absolutely.

Their submission document can be found at the link below.

Category 1 Suspension Review Registration Form_20240209102307_20240223155811.docx

From the Salzgitter Mannesmann UK Ltd submission document:

Salzgitter are concerned about market distortion due to the proposed suspension of quotas as requested by Tata, namely,

- If Tata were to have no limit on the import volume of Hot Rolled Coils under category 1, there is a risk that they could displace the role of traditional import steel traders to the UK by buying volume in bulk quantities far in excess of usual traded volumes and marketing this to UK customers at discounted prices, having benefited from lower costs of purchase and ocean freight costs as a significant volume buyer. This would enable Tata to partly use the volume for their downstream operations, but also partly sell to the open market and replace the role of UK international steel traders.

- The definition from Tata of “downstream processing” should be clarified, how can it be proven that all Tata purchases are used for their own downstream processing and how can this be tracked?

- Salzgitter’s UK customer base consists primarily of service centres that compete with some of Tata’s downstream processing divisions. Tata's ability to import unlimited tonnes of Hot Rolled Coils provides them with an unfair advantage against independent UK service centres (Salzgitter customers) as they will have a significant price advantage due to volume economies of scale-based purchasing. This scenario would put the traditional business of UK steel importers and their customers at risk.

- In line with the first point mentioned above, Tata also owns their own import trading company, Tata International, which could benefit from the parent company's bulk purchases.

Reviewing the Submission Documentation

As part of the thorough TRA Review process, all submissions from interested parties are studied and given due consideration

The TRA then submits a recommendation to the Secretary of State, who can allow implementation of the recommendation or request further investigation and evidence supporting the proposed changes.

Once this process has been duly followed, the final report is published, clearly indicating any measures to be implemented, removed or adjusted.

In this case, the Secretary of State requested a review of the TRA recommendation. The document (link below) sets out the case for the regulatory background for the bounce back to the TRA for further case consideration. The document can be found here:

Initial Findings Report_20241104095351.pdf

The Reassessment of Suspension Review findings are published in the following document:

Reassessment of Suspension Review- Final Report_20241216091954.pdf

In the Reassessment document above, the following detail was given to clarify the reasoning behind the Secretary of State’s decision for a review of the initial findings, with the TRA commenting further on the reasons why the Secretary’s decision was accepted in that new information had come to light since the submission of the initial findings and recommendations were presented.

Such detailed provision of evidence qualifies that due process has been followed and that interested parties have been allowed to submit differing impact opinions and counterarguments.

The document details how the safeguard measure changes will be reflected in the UK Global Tariff.

Detail from the Reassessment of Suspension Review – Final Report 20241216091954

Extract in Italics:

Evidence – and the implementation of category 1B, which will be reflected in tariff quota measures:

18. Following the Secretary of State’s decision to accept the TRA’s

recommendation, the TRQ for Category 1 steel products has undergone the following changes:

a. Category 1 has been amended to form Categories 1A and 1B;

b. Category 1A will retain the country allocations and the quota amount established in

Trade Remedies notice 2024/06: safeguard measure –tariff-rate quota on steel goods;

c. Category 1B is for use by businesses importing goods for downstream

processing;

d. The quota amount for Category 1B has been increased to 132% above the previous Category 1 TRQ to around 2.3 million tonnes;

e. Category 1B is allocated on a global basis; however, there is a 40%

cap on exports per quarter for an individual country or territory.

19. The TRA agrees that the Secretary of State’s decision to accept the TRQ review recommendation represents new information unavailable when the TRA made its original recommendation in the suspension review.

20. Following that decision, the new TRQ amount for Category 1A and 1B combined is now more than three times as large as when it made its original recommendation in the suspension review.

21. From July 2023, the residual quota for Category 1 was exhausted early in each quarter. For the July to September 2024 quarter, the residual quota was exhausted within the first week.

22. The change made to the quota amount following the TRQ review directly

addresses the temporary change in market conditions that formed the basis for the TRA’s suspension recommendation, namely that importers and distributors struggled to access a sufficient supply of Category 1 steel products without incurring the 25% safeguarding duty.

23. The new TRQ came into effect on 1 October 2024, and as of 6 December 2024, the residual quota for Category 1A is 49% filled.C2 Comments from parties on the temporary change to market conditions

24. When the TRA published its notice of reassessment on 30 September 2024, it provided parties with the opportunity to comment on the reassessment, particularly in relation to the temporary change in market conditions, which formed the basis of the TRA’s original recommendation. Parties were provided with a further opportunity to comment when the TRA published its initial findings report on 4 November 2024. Non-confidential versions of

Submissions received in response to the notice are available in the public file.

25. TSUK submitted that it no longer supported the suspended measure, as it considered the circumstances justifying a suspension to have been resolved. As a consequence of the creation of Category 1B, TSUK noted that its “increased demand for HRFS imports to support [its] downstream assets has been addressed and no longer constitutes a temporary change in

circumstances.”

End of quotation from the document.

The document reflects Tata's (TSUK) agreement in Article 25, supporting the change in measures and that the introduction of Category 1B (at 18.c. above) appropriately addressed their concerns regarding their downstream assets.

Conclusion

The Trade Remedies Authority aims to follow due process and to present a reasoned, supported case to the UK government as represented by the Secretary of State, who in turn has an obligation to support the process further and offer recommendations towards review to ensure that due process for safeguarding measures is followed, and regulatory obligations are met.

It is then the responsibility of the Department of Business and Trade to ensure that the measures are appropriately provisioned within the UK Global Tariff.

UK Safeguarding Legislation can be found at the link below:

Determining safeguard measures - GOV.UK

World Trade Organisation Agreement on Safeguards is available here:

WTO | legal texts - Agreement on Safeguards

OneCall™ Email assistance as and when required; A one-call solution for all your import, export and customs enquiries. Export help. Import help. Customs help.

Stay informed about customs and international trade matters by subscribing to our OneCall™ service. This comprehensive offering includes a dedicated email helpline for support, timely practical updates direct to your inbox (Did You Know?), monthly UK Customs & Trade Briefings and access to an interactive members' area with an exclusive community for our subscribers.

International Trade Updates & Spotlight Newsletter

Subscribe to our free information emails covering international trade topics...