BY:

SHARE:

HMRC is reminding traders of the removal of the 999L Export Measures waiver code for implementation from 31st January 2025. Using the 999L code for goods exported after that date will cause the export declaration to be rejected on CDS. This will include pre-lodged exports that ‘arrived’ post-31st January 2025.

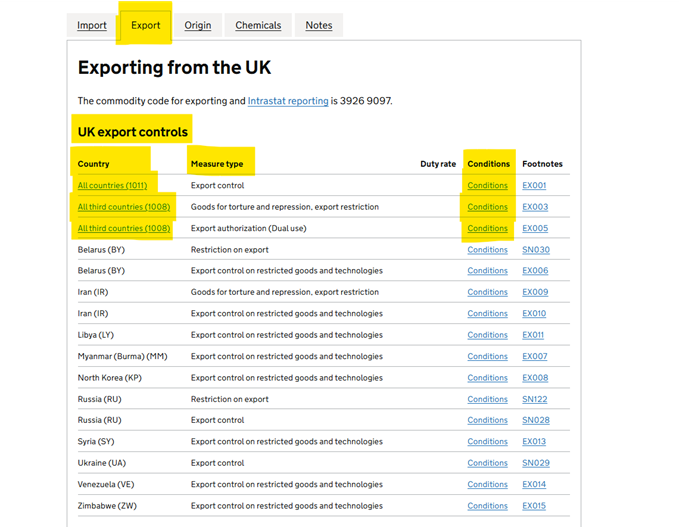

The 999L code was removed from CDS for imports in January of this year.

Exporters are reminded to consult the Exports tab for their commodity codes on the UK Global Trade Tariff for all the goods to be exported, checking whether export measures apply for any given commodity codes.

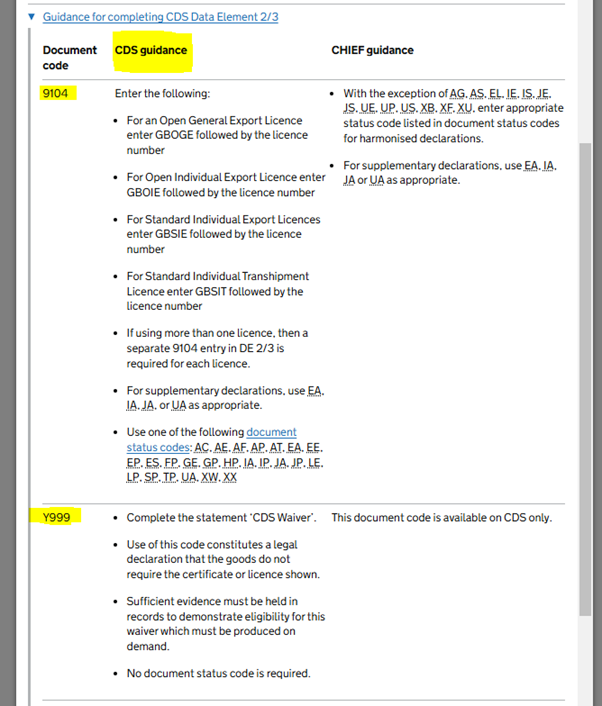

The exporter or the representative making the declaration for the exporter must confirm whether an export measure applies by selecting the appropriate coding in CDS at Data Element 2/3.

Compliance due diligence:

The exporter is obliged to have applied due diligence to all export measures for goods for export and should hold appropriate compliance evidence confirming that an export measure is not required against a specific export if using an export measure waiver code.

Information on CDS codes at data element 2/3 can be found here

Below is an example demonstrating how to navigate the Trade Tariff to identify the document codes now required for CDS Exports as a replacement for 999L.

Example

1. Visit https://www.trade-tariff.service.gov.uk/ and input the Commodity code.

2. Keep the default setting for trade between the UK and All Countries.

3. Navigate to the "Exporting from the UK" section and locate the ‘UK Exports Controls’ tab to determine if the measure type is applicable to the goods.

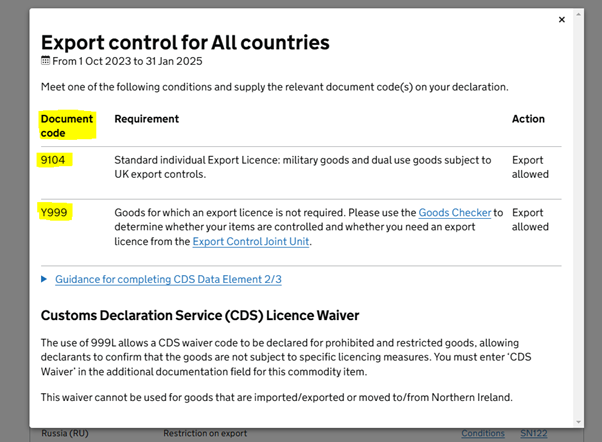

4. Click on "Conditions" to open the relevant window. For this demonstration, the user has selected the conditions for all countries; however, it should be determined if any of the other countries' specific conditions apply to the goods. Within the first control, there are two different scenarios, and the correct code must be used for export. Ensure to read through each scenario and follow the legislation links, if needed, to determine the applicable code or combination of codes for the goods being exported.

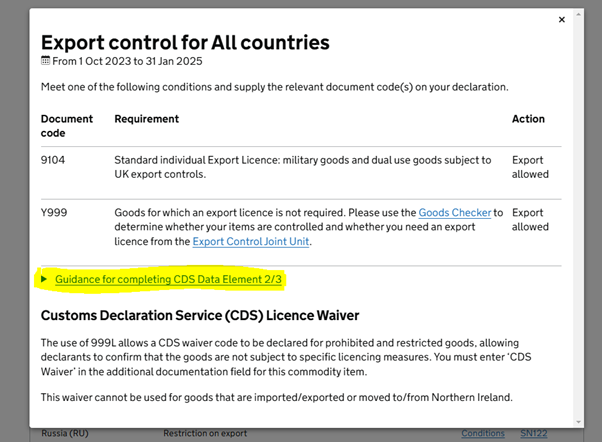

5. Once the user identifies the correct code, they should scroll down in the ‘Condition’ tab. An option to access guidance for completing CDS Data Element 2/3 will be available.

6. Upon opening the provided link, the CDS guidance corresponding to each document code will be displayed

Correctly complete the export declaration using the alternative code to 999L or provide instructions to the agent submitting the export declaration.

8. Repeat these steps for each Commodity code where 999L was previously used

The article on the removal of 999L for imports can be found here:

Removal Reminder for 999L - Essential Steps to Take for UK Imports

OneCall™ Email assistance as and when required; A one-call solution for all your import, export and customs enquiries. Export help. Import help. Customs help.

Stay informed about customs and international trade matters by subscribing to our OneCall™ service. This comprehensive offering includes a dedicated email helpline for support, timely practical updates direct to your inbox (Did You Know?), monthly UK Customs & Trade Briefings and access to an interactive members' area with an exclusive community for our subscribers.

International Trade Updates & Spotlight Newsletter

Subscribe to our free information emails covering international trade topics...